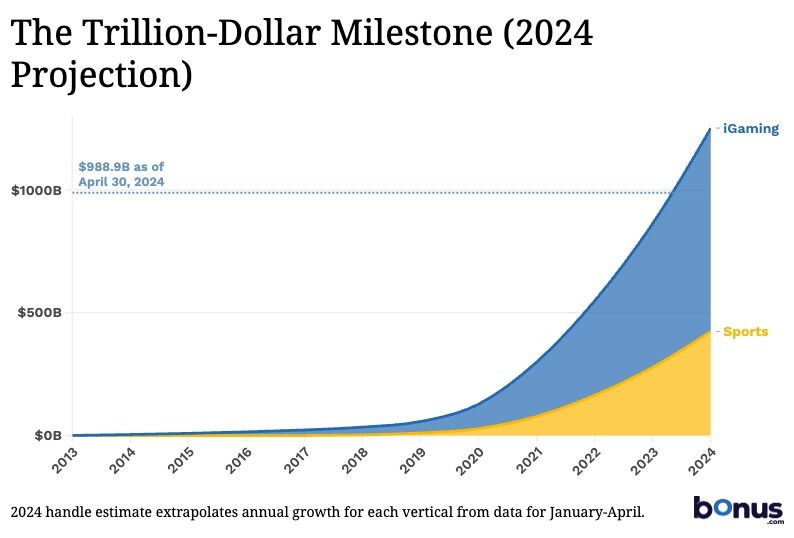

It has gone unnoticed, but the US has just hit an important online gambling milestone: Americans have now placed $1 trillion in legal online wagers at regulated internet casinos, sportsbooks, and poker rooms. By my estimate, the bet that pushed the industry into ten-figure territory would have been placed sometime in the middle of this month, perhaps on or around May 11.

From their legal debut in 2018 to April 30, US online sportsbooks reported a total of $321.5 billion in handle, per my colleague Eric Ramsey at Legal Sports Report. An exact figure for online casinos isn’t available. However, based on revenue data, I estimate their combined wagers through April 30 to be $667.4 billion.

That gives a total of $988.9 billion in legal wagers coming into May.

How fast are Americans adding to that total? As it turns out, the current rate of wagering is very close to $1 billion per day.

That means the industry likely hit the trillion-dollar mark somewhere toward the middle of the month.

Betting a Billion Each Day

One billion dollars per day is actually a little slower than the pace of betting was a few months ago before the NFL season came to an end. Aside from that seasonality, though, the pace has grown steadily over the years.

At the current rate, Americans of legal gambling age—i.e., 21 and up—are each betting an average of $5 per day.

That may sound alarming, but it’s important to remember that wagers don’t equal spending. Casinos and sportsbooks return the bulk of each wager to players as winnings, keeping only a small percentage on average.

- Read More: Casino School—Game Odds & Payout Odds

Converted into spending, that $5 in wagers equals about 26 cents lost per day or just over $90 per year. Sportsbooks account for only about one-third of wagering but slightly over half of all losses (or winnings, from the industry’s point of view) because they keep more of each bet.

As a point of comparison, Americans 18 and up spent an average of about $434 on lottery tickets in 2023—$113 billion for about 261 million adults. However, all but five states now have a lottery. The amount spent at online casinos and sportsbooks is concentrated in a smaller number of states whose residents can play legally without traveling.

Before I get further into hold percentages, I want to give you a visual history of how the industry reached the $1 trillion mark.

The Road to One Trillion

Differences in Hold: Sportsbooks and Casinos

Though they’ll take either side of most bets, sportsbooks turn a profit by adding “juice” to the odds they offer. For instance, they’ll typically ask players to put up $11 against the book’s $10 on a 50/50 proposition. However, they don’t always manage to get the money on each side to balance, so they’re still vulnerable to short-term swings based on bettors’ preferences and the results of the games.

Since launch, the average hold for all legal US sportsbooks across all states has been 8.4%. However, it’s common to see anything between 5% and 15% for individual months in specific markets. More rarely, you’ll find examples of negative hold in a month or of states hitting 25% or more.

By contrast, casino game results are purely random and not tied to real-world events. The volume of play in a month is high enough that the hold percentage becomes relatively stable.

Online slots hold about 4%, significantly less than most retail machines. Table games often hold even less, although it depends on the game. Taking all the products together, the average hold for online casino gaming is 3.4% in West Virginia and 3.0% in Connecticut. Those are the only two states reporting that data.

The difference may come down to the mix of operators present in each state. Connecticut is a duopoly in which both products—DraftKings and the FanDuel-powered Mohegan Sun—are designed for sports bettors.

American sports bettors play more blackjack than the average casino-goer, and the house edge for that game is under 1% when using the correct strategy. So, that may be what makes for a lower hold in Connecticut. By contrast, West Virginia has a broader mix of operators, including some that cater to a more traditional slots-focused audience.

For the other states, I used an estimate of 3.25% hold. I opted to use a value slightly higher than a straight average because they have a mix of operators more like West Virginia’s. Their iGaming numbers also include a tiny contribution from online poker, the rake for which is closer to a sportsbook’s hold than a casino’s edge.

US Online Gambling Continues to Grow

Online gambling wagering and revenue grew explosively from 2019 to 2021 for three reasons:

- New state markets were opening continuously thanks to a wave of successful gambling expansion legislation.

- Being able to gamble online legally was a much-hyped novelty for most Americans.

- The COVID-19 pandemic temporarily shut down retail casinos, driving large numbers of gamblers to try the online apps.

Sports betting lagged a bit in 2020 because COVID-19 also temporarily created a shortage of events to bet on. However, sportsbooks made up for lost time the following year.

From 2022 onward, the pace of legalization has been much slower, particularly for online casinos. Even now, online casino gaming in three states—New Jersey, Michigan, and Pennsylvania—accounts for almost 60% of all legal online wagering that has taken place in the US. That’s almost as much as online sports betting across the 29 states where that’s legal.

And yet, several years after launching, these markets continue to grow rapidly. Year-over-year growth in sports betting revenue through the first four months of 2024 was about 12%. Online casino growth has been double that, around 24%. That actually represents an acceleration since 2023, the full-year growth rate for which was just shy of 23%.

All-time combined wagering should reach around $1.25 billion by the end of the year. Online casinos will have accounted for roughly two-thirds of that. They’re on pace for just under $830 billion by my estimate.

And that means they’ll hit their own trillion-dollar milestone sometime next year without needing to factor in the sportsbooks.