The Pennsylvania Gaming Control Board (PGCB) released its 2021-2022 Annual Report earlier this month. Most key numbers for the state’s gambling industry have gone up year over year, including many all-time highs.

State tax alone (not counting local grants, etc.) amounted to $1.43 billion from gambling in the 2021-2022 fiscal year, up 29% from $1.11 billion in 2020-2021. Not every record is one to be celebrated, however. Alongside the increase in gambling revenue and taxes is a rise in the number of Pennsylvanians putting themselves in the state’s voluntary self-exclusion registries.

Initially, there was only a single registry, for retail casinos. In 2019, the PGCB added three more, bringing the total to four:

- Retail casinos & sportsbooks

- iGaming

- Video lottery terminals

- Fantasy contests

Self-exclusion can be for a term of one year, five years, or permanent. Operators must avoid serving anyone who has self-excluded. If someone on the registry is caught gambling, the PGCB will seize their winnings.

The PGCB’s fiscal year begins July 1, but it provides self-exclusion numbers for each calendar year. The full-year total for 2021 was 2,891 self-exclusions. That, on its own, was already almost twice any previous year, but 2022 is on course to exceed that figure by a wide margin.

The report provides numbers up to June 30, 2022. During those six months, an additional 1,931 gamblers requested self-exclusion. In past years, numbers for H2 have tended to be slightly higher than H1, so even a conservative prediction suggests 3,900, perhaps 4,000 self-exclusions before the year is out.

Does this mean Pennsylvania is facing an epidemic of problem gambling? Not necessarily. Bonus dug more deeply into the numbers and spoke with representatives of the PGCB and the Council on Compulsive Gambling of PA (CCGP) to understand what’s going on in the Keystone State.

New Self-Exclusion Registries Grow Larger Than Retail

We’re not just seeing self-exclusions rocket to record heights. We’re also seeing a shift in which types of self-exclusion Pennsylvanians opt for.

We’re not just seeing self-exclusions rocket to record heights. We’re also seeing a shift in which types of self-exclusion Pennsylvanians opt for.

For the first half of the year, 1,011 Pennsylvanians added themselves to the newer registries, excluding themselves from participation in online gambling, VLTs or fantasy contests. The number for online gambling may creep up further in the second half of the year, as that’s the fastest-growing segment.

Online gambling is relatively new in Pennsylvania, having been introduced in 2019. Naturally, the existence of a new registry would lead to more people adding themselves to it. Many of those have probably already excluded themselves from other types of gaming.

The accessibility of online gambling also means more people are gambling than ever before. Another consideration is the recent opening of new casinos and the addition of more VLTs. The connection between new gaming options and a temporary rise in problem gambling rates is something the PGCB anticipated.

Elizabeth Lanza, Director of the PGCB’s Office of Compulsive and Problem Gambling, told Bonus:

When a new casino opens, studies show that you get a one-to-two year spike, then it levels off again.

She says it’s the same story with online gambling as well:

More sites are opening. People are playing on more sites at once.

For this and other reasons we’re about to get into, Bonus would expect the growth in retail self-exclusions to slow down but for online to continue to surge. A conservative estimate for 2023 might be 4,500 exclusions in total.

Organic Growth is Most of the Story for Online Self-Exclusions

Every state with legal online casinos has seen substantial annual revenue growth. In 2020, the increase was especially dramatic due to the temporary shutdown of retail casinos in response to COVID-19.

Every state with legal online casinos has seen substantial annual revenue growth. In 2020, the increase was especially dramatic due to the temporary shutdown of retail casinos in response to COVID-19.

In Pennsylvania, that boom was compounded by the fact that the market was so new. Although Pennsylvania online casino gaming began in July 2019, it got off to a slow start. Some major operators like FanDuel only launched in 2020.

Combined iGaming and online sports betting revenue for Pennsylvania increased almost tenfold from 2019 to 2020. Today, the annual growth rate is closer to 25%, comparable to New Jersey and Michigan.

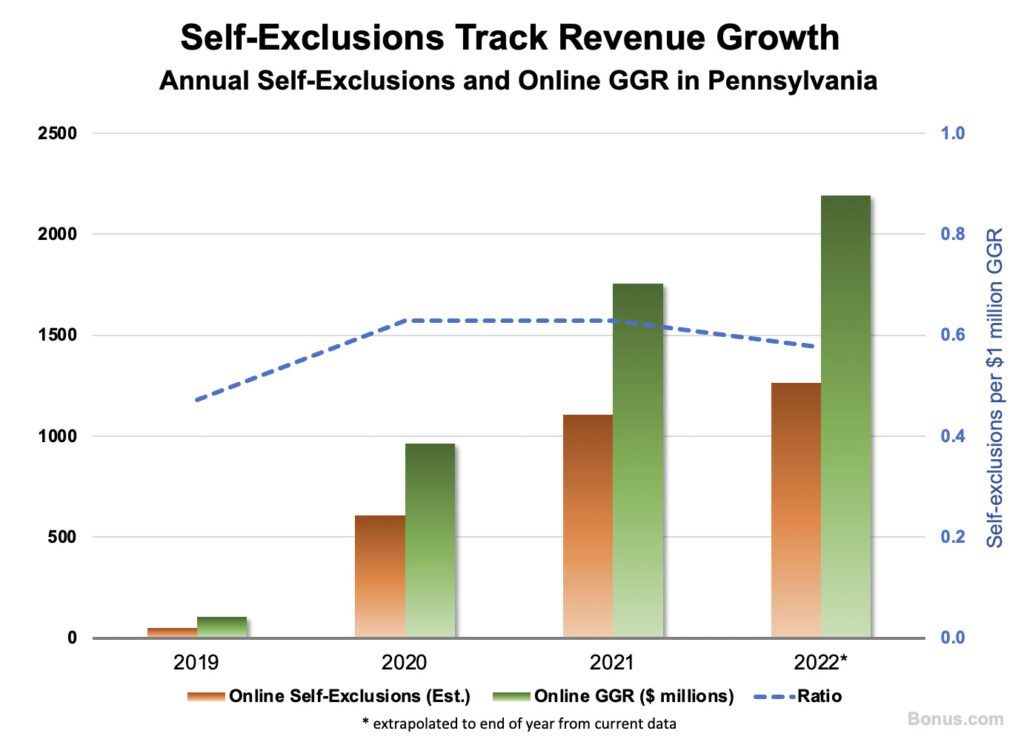

Intuitively, more people gambling will lead to more people encountering a problem with it. For Pennsylvania online gambling, that appears to be the case.

Growth on both fronts has been slowing down somewhat, yet the correlation is evident when you plot them side by side.

At the moment, it looks as if the ratio for the correlation is closing in on about one annual self-exclusion per $600,000 in annual gross gaming revenue. That said, if the launch effects Lanza mentioned for retail casinos are also similar in the online space, we may see the trend reverse itself, and the final ratio could end up being lower.

Pennsylvania Retail Gambling Expansion

The new retail casinos Lanza mentioned are primarily mini-casinos, also referred to as “satellites.” The one exception is Cordish Companies’ Live! Hotel & Casino Philadelphia – a full-sized property that opened last year.

The new retail casinos Lanza mentioned are primarily mini-casinos, also referred to as “satellites.” The one exception is Cordish Companies’ Live! Hotel & Casino Philadelphia – a full-sized property that opened last year.

Although smaller than the full-sized casinos, the mini-casinos are still pretty substantial establishments with up to 750 slot machines and 40 table games.

Although the state initially planned to allow up to 10 of these, interest was lower than expected, and only five licenses got sold. Three of those casinos have now opened, with Parx Shippensburg and Bally’s State College being the two left to come.

With most of those new openings now in the past, the growth in retail self-exclusions may slow down. Lanza’s “one-to-two year” timeline for stabilization is why Bonus has projected only a slight further increase in retail self-exclusions for 2023.

One caveat here is that three of the recent openings were in the densely-populated southeastern corner of the state, close to Philadelphia, while the fourth was on the outskirts of Pittsburgh. Those areas were already well-served by existing casinos.

Conversely, the new Bally’s and Parx properties will be closer to the middle of the state. State College, in particular, is nearly a two-hour drive from the nearest existing casino. These new locations may therefore have a disproportionate impact, creating nearby gambling options for residents who previously lacked one.

Helpline Calls Also on the Rise

Calls to Pennsylvania’s problem gambling helpline are another telling metric. Like the PGCB, the CCGP makes this data available in its annual reports.

Calls to Pennsylvania’s problem gambling helpline are another telling metric. Like the PGCB, the CCGP makes this data available in its annual reports.

Total calls in Pennsylvania rose 45% in 2021 and are on track for a 13% increase in 2022. On the surface, that’s only about half of the rise we see in self-exclusions. That increase was 92% for 2021 and a projected 35% for 2022.

However, the figures for total calls include some hang-ups, a few wrong numbers, and a large number of people who mistake gambling help lines for casino customer service or technical support.

The more relevant metric is the number of “intake” calls, i.e., those which result in a gambler receiving help for their problem. The percentage of intake calls has also risen, from a baseline of around 10% up until 2020 to 12% in 2021 and nearly 14% for calls this year.

The number of intake calls rose by 87% in 2021 and should be up another 31% by the end of this year. Those numbers are more in line with those for self-exclusions. Indeed, roughly half of the intake calls so far this year have resulted in the caller being referred to the PGCB with the suggestion to register themselves for self-exclusion.

CCGP Executive Director Josh Ercole remarked on similar trends to those pointed out by Lanza at the PGCB. The average age of callers is decreasing, with the 25-34 age band accounting for 21% of intakes so far this year, compared to 16% in 2019, before the arrival of legal online casinos and sportsbooks. (Gamblers can call the hotline for help with their habits regardless of whether they play on regulated sites or illegal offshore ones. Self-exclusion, however, only applies to sites regulated in Pennsylvania.)

34% of intake callers this year have named “internet” or “sports” gambling as their biggest problem, compared to 30% in 2021, 28% in 2020 and just 8% in 2019.

However, Ercole points out that a rise in call volume might not be bad news:

While higher call volume may point toward more problems, I think it’s also important to look at other possibilities. These new forms of gambling have resulted in a significant increase in advertising. With this increase, there is a silver lining, and that’s the fact that included in the messaging is a link to help via the 1-800-GAMBLER number. So, while an increase in problems is certainly likely, I’d also like to believe that part of the increase is due to overall increased awareness of the helpline – something we continually try to promote.

Other Factors in Self-Exclusion

Gambling expansion is probably the most significant factor contributing to increased self-exclusions, but it may not be the only one.

Lanza says there are a lot of variables involved. Like many of those whose work concerns problem gambling, she expressed frustration at the lack of good research on the topic.

Unfortunately, there’s not a lot of funding, especially at the federal level. We just need more research. There are no studies being done on these self-exclusion numbers. That sort of research would be very beneficial but unfortunately we just don’t have that crystal ball.

Some other factors likely to have played a role are the disruptions caused by the pandemic, the ongoing economic downturn, and a demographic shift brought about by the new forms of gambling.

Pandemic Rebound

The COVID-19 pandemic forced the shutdown of retail casinos in 2020. At the same time, the PGCB’s offices also closed, which put a halt to self-exclusions until the Board could implement an online self-exclusion option.

By now, probably everyone who wanted to self-exclude in Spring 2020 but had to wait has already done so. However, the interruption of retail gambling may also have postponed the development of addiction for some at-risk players. Part of the drop in retail self-exclusions in 2020 – from 1,439 in 2019 to just 731 – may represent self-exclusions that were going to happen eventually but, in effect, were deferred until a later year by the pandemic.

Many retail gamblers also switched to playing online during lockdown. That almost certainly drove some of the increase in online self-exclusions and may be driving increased retail self-exclusions now that people are switching back.

Demographic Shifts

Lanza points out that the average age of self-exclusions is going down. She believes that sports betting is behind a lot of the increase. Young men are the core demographic for sportsbooks and also represent the highest risk category for gambling problems.

Online casino audiences also skew somewhat younger than their retail counterparts. Lanza says:

Many of these young people have no previous experience gambling. iGaming and sports betting have only been around for three years, so some may only be developing a problem now.

She also believes that some of the increase in retail self-exclusions is crossover from online sports betting. Someone who self-excludes from online betting may discover they can still place bets at retail sportsbooks. They can’t then self-exclude from retail sports betting without having themselves barred from the casino premises in their entirety.

Economic Struggles

The economy has also been teetering on the brink of a recession since the pandemic. Gambling to try to make money, rather than for entertainment, is a significant risk factor for problem gambling. That risk becomes higher when people are feeling desperate.

Lanza acknowledges that the economic climate may be making things worse:

A stressor of any sort can certainly affect anyone at risk of addiction. A recession can drive people to look for a way out.

What we really need is for people to understand that gambling is entertainment. Those who are looking to make money are at greater risk. Chasing losses or gambling with money you need to pay your bills will only put you further behind.