Unibet will become the next casualty of the hyper-competitive US online gambling market, as its owner, Kindred Group, told investors that it will close its remaining American sites by the end of Q2 2024. The news comes a little over a year after it decided to shut down its site in Iowa and focus more on “multiproduct” states, meaning those where online casinos are legal.

The strategic shift meant that Unibet abandoned plans to launch in Illinois and Ohio. However, it retained its sportsbooks in Arizona, Indiana and Virginia, as well as its hybrid casino-sportsbooks in New Jersey and Pennsylvania.

These sites will all shut down over the next seven months, pending regulatory approval. Existing users need not worry. Unibet account balances will remain safe, and users will have ample time and forewarning to withdraw their funds before the sites shut down.

The company plans to reduce its headcount by 300 in 2024, which includes all North American employees and consultants. Interim CEO Nils Andén said:

The cost reduction actions announced today are both necessary and decisive. While it is never a desire to inform valued colleagues of redundancies, this puts us in a stronger position to secure long-term growth for Kindred across our locally regulated core markets. We can now focus our resources and tech capacity towards strategic initiatives and selected markets where we see clear potential to grow our market share.

Pennsylvania Revenue Data Highlights Unibet’s Struggles

Growing market share has indeed been a problem for Unibet in the US.

Growing market share has indeed been a problem for Unibet in the US.

In October 2022, when announcing its strategic shift towards iGaming, Unibet expressed the modest desire to be a top ten online casino operator in the US. Although that was putting a rosy spin on things, a top-ten ranking does not mean very much in a market dominated by a few players.

Michigan is the only online casino market that discloses individual revenue for all operators. There, the top three—BetMGM, FanDuel, and DraftKings—hold over 70% of the market. Tenth place in that market is currently PokerStars, with 1.6%.

Although Unibet doesn’t operate in Michigan, that figure is similar to the 1.7% of the Pennsylvania online casino market it held in October 2022. Since then, however, it has lost share rather than gained any.

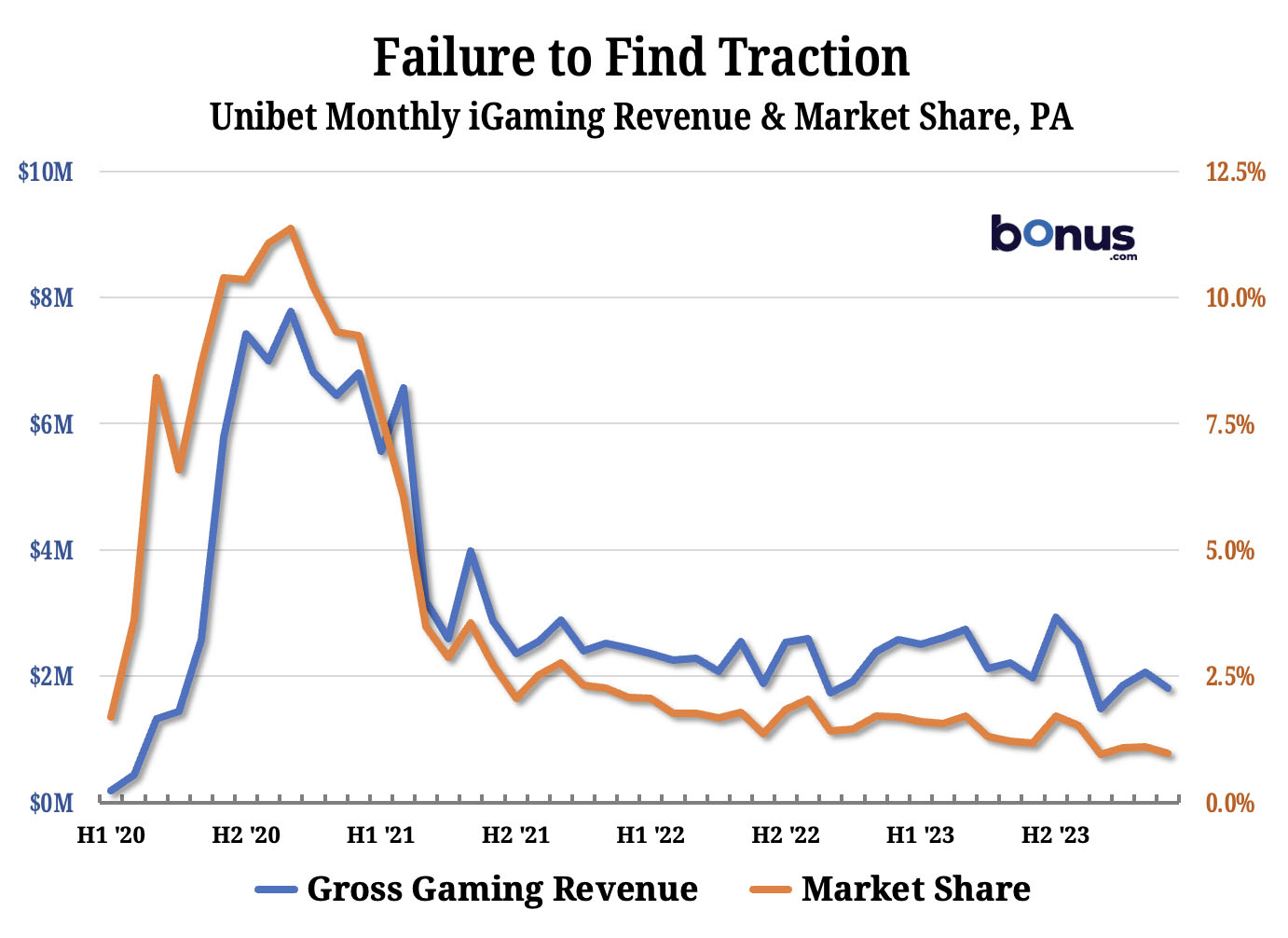

Unibet had a promising start in Pennsylvania in late 2019 when few other operators had yet launched. Its monthly revenue peaked at $7.8 million in June the following year, when it held 11.1% of the market.

But where other online operators prospered in the aftermath of the COVID-19 lockdowns, Unibet seemed to falter. Its revenue had dropped by half by the end of 2020 and its market share by three-quarters.

Since then, its monthly revenue has been almost stable, declining only slightly. On the other hand, the rest of the market has been growing at an annual rate of more than 20%. Unibet has seen its share continue to slip by failing to grow along with the market. In October 2023, the most recent month for which we have data, it fell below 1% for the first time.

Unibet Sports Betting Never Clicked

Online casino gaming might have kept Unibet in the market if it had turned things around in New Jersey and Pennsylvania. However, sports betting is typically about half as lucrative as iGaming in markets that have both, and Unibet had an even harder time establishing itself in that vertical.

Before shutting down in Iowa, Unibet Sportsbook had never had a month in which it held more than a 0.3% share of betting handle. Its best performance (out of states where individual data is available) has been in Pennsylvania, where—assisted by its casino and early market entrance—it has held 1.5% of handle across its lifetime. Even there, however, it dipped below 1% in January 2023 and has not recovered.

In Indiana, its lifetime share of handle is 0.6%, and in Arizona, just 0.2%.