Bet365 is the undisputed top dog of sports betting in the United Kingdom, but you wouldn’t know that just by looking at its US presence. For most of the short history of US sports betting, it has stayed quietly in the back seat, allowing the likes of DraftKings, FanDuel, and BetMGM to shovel money on the marketing bonfire in pursuit of market dominance. Now, it has more than doubled its New Jersey sports betting market share in six months and has an important launch coming soon in Pennsylvania.

Is it probably wise to have done so. The US market has already produced numerous casualties in just a few years. Two factors that have tended to bode poorly for market hopefuls: Not having a homegrown US brand and putting too much emphasis on sports over online casino. Had bet365 committed too much, too early, it might now be beating a retreat along with Unibet and others.

But if the plan was to wait for the market to simmer down a little before making a move, now might be the time.

Like many other operators, bet365 made its US debut in New Jersey in 2019, not long after sports betting became legal. However, unlike most competitors, it stopped there until September 2022, when it added Colorado as its second state.

It made its move in sports betting last year, launching in Ohio, Virginia, Iowa, Kentucky, and Louisiana in rapid succession. Indiana followed this year.

However, all those markets after New Jersey were states that only allowed sports betting. We’ve known since January 2023 that its hybrid casino-sportsbook would eventually come to Pennsylvania, as Churchill Downs Inc. (CDI) announced that the two had struck a market access deal after pulling the plug on its own casino-sportsbook, TwinSpires.

Bet365’s New Jersey Market Share Grows

There are signs that the bet365 launch in Pennsylvania is coming soon. In the meantime, it’s been having a great year in neighboring New Jersey, its first state.

Until this year, the New Jersey Division of Gaming Enforcement reported online gaming revenue by master license. Since several operators share each license, it was impossible to tell how smaller brands like bet365 were doing.

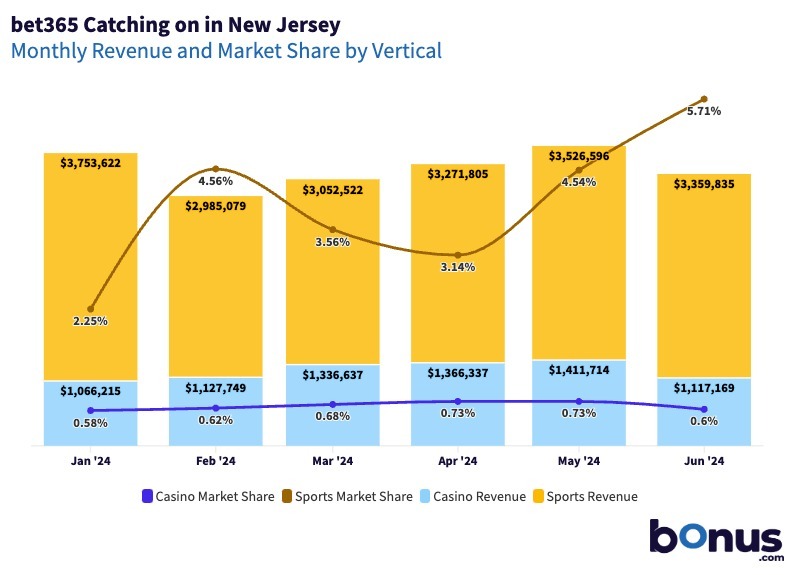

Since January, that has changed. We now have unprecedented insight into the industry dynamics in the state. One of the things we can see is that bet365 has been stepping on the gas, especially on the sports betting vertical.

For most US sportsbooks, business is heavily dependent on the NFL season. Interest in NCAA basketball keeps numbers high through March Madness, but revenue drops precipitously in April and stays low until football returns in September. Online casino revenue follows a similar but more subtle trend.

Not so for bet365, which made May its biggest month of the year, with nearly $5 million in combined revenue from both verticals. Although June was a little slower, its sports revenue did not drop as much as that of competitors, and its market share grew to 5.71%, up from 2.25% to start the year. That’s almost as much of the market as BetMGM holds and more than the likes of Caesars, BetRivers, ESPN Bet, and Fanatics.

That said, its casino market share is still less than 1%. Even internationally, it had been treating that vertical as an afterthought until recently and is now playing catch-up. It will be interesting to see whether Pennsylvanians respond well to its online casino product or whether, there too, its revenue remains lopsidedly in favor of sports. The New Jersey online casino market is extremely crowded, with 32 brands fighting for attention. Pennsylvania is relatively less crowded, with 21.