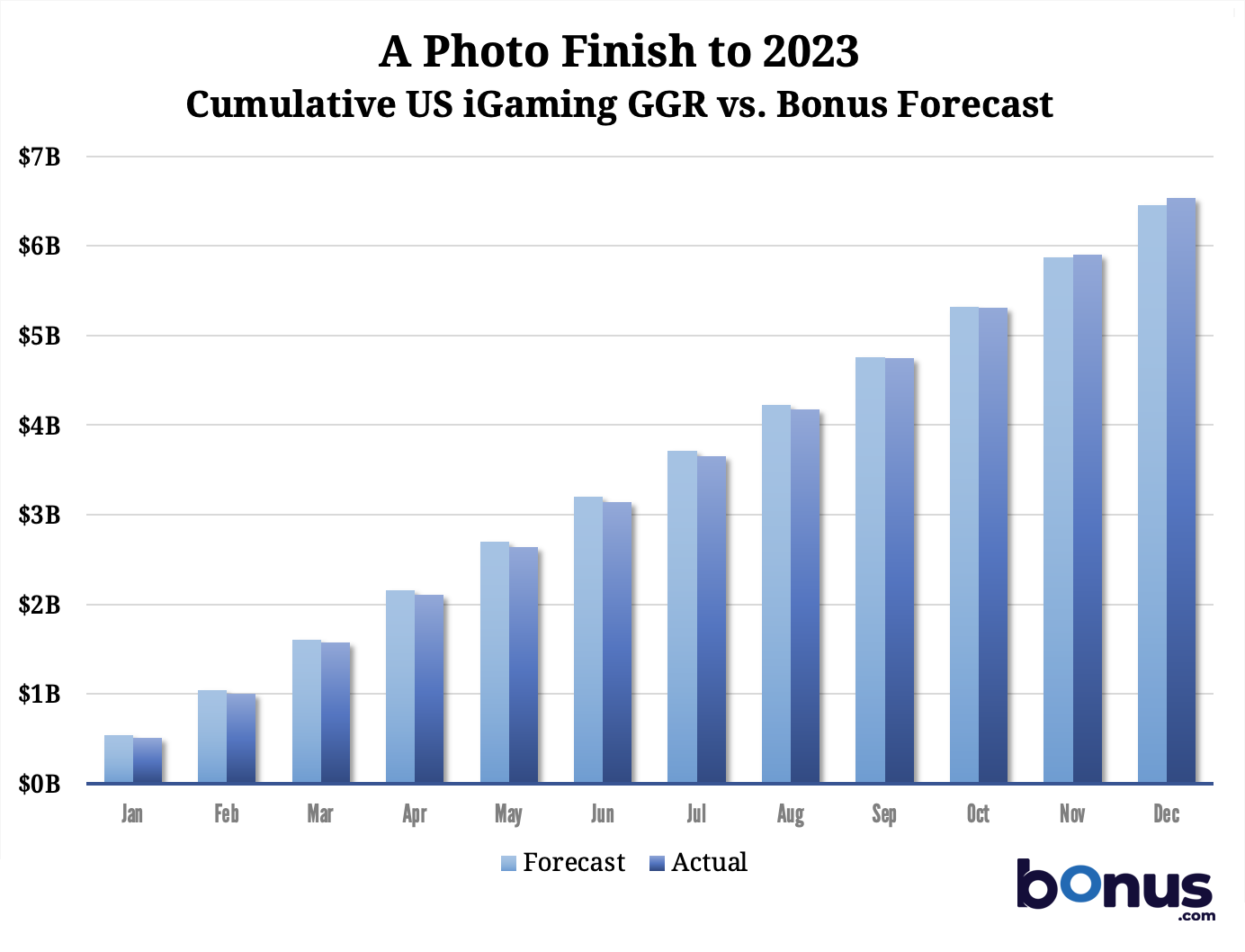

US online casinos generated a combined total of $6.5 billion in 2023 across six states, just as I predicted for Bonus one year ago. In fact, the industry did slightly better than the prediction: my $6.5 billion estimate was rounded up from $6.46 billion, while the actual total exceeded that by 1.1%, coming in at $6.53 billion now that regulators have posted their tax documents for December.

The market’s performance changed dramatically over the course of 2023. Most states lagged significantly behind the forecast in the first half of the year, especially during Q1. However, I expected a significant growth slowdown in the second half of the year. Although growth rates did drop in H2, the slowdown was slight and gradual for most states.

The market’s performance changed dramatically over the course of 2023. Most states lagged significantly behind the forecast in the first half of the year, especially during Q1. However, I expected a significant growth slowdown in the second half of the year. Although growth rates did drop in H2, the slowdown was slight and gradual for most states.

By fall, the market had caught up with the projection and pulled ahead in the final quarter. Pennsylvania, New Jersey, and Connecticut all exceeded expectations, the latter by a wide margin. Michigan and West Virginia came up short, but not by much. Only Delaware was disappointing, but its contribution to the national total is tiny, and its change of suppliers might help things in 2024.

To some extent, this may have been an artifact of my approach to forecasting, which I’ve attempted to refine in my 2024 projection for PlayUSA. However, there were larger economic forces at play that may have helped counteract the natural market slowdown in H2. For instance, the inflation rate has stabilized since coming down from a high of 9.1% in summer 2022, and gas prices have come down. Stock market indices have begun to rise again after a long period of stagnation. Some American gamblers may have more disposable income to play with than they did in the first half of 2023.

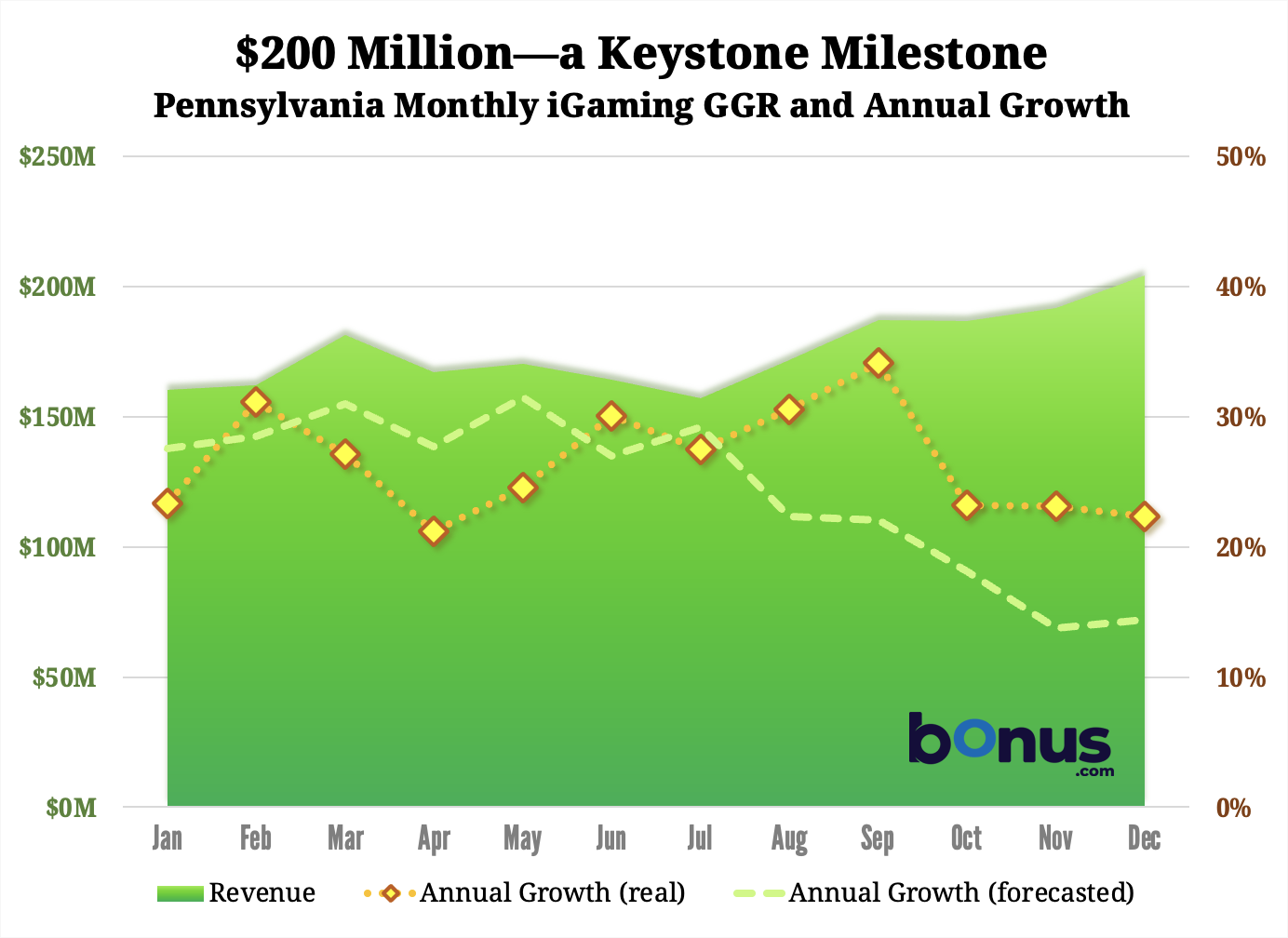

Pennsylvania Crosses the $200 Million Mark

Connecticut was the breakout success story of 2023, beating the forecast by nearly 10%. However, as a relatively new market, it didn’t provide much historical data to work with, so it’s not surprising that the projections would be off.

Connecticut was the breakout success story of 2023, beating the forecast by nearly 10%. However, as a relatively new market, it didn’t provide much historical data to work with, so it’s not surprising that the projections would be off.

By contrast, the surge Pennsylvania experienced in the second half of the year was more unexpected. Its full-year total was a modest 1.9% above the projection, at $2.11 billion compared to $2.07 billion. However, its monthly totals from August through December beat the forecast by margins between 4.3% and 9.9%. This has also made it the first and only state to exceed $2 billion in a year.

Having launched in 2019, it is the second-longest-running market in the US after New Jersey. For that reason, I expected their growth rates to start converging in 2023. However, the actual growth rate for Pennsylvania didn’t drop by very much. It started the year at 23.3% and ended at 22.4% after having risen to as high as 34.1% in September.

That strong finish propelled Pennsylvania past the $200 million monthly revenue mark in December, something I hadn’t expected to happen until 2024. Online gambling operators increased their daily average win by 3.0%, collecting $204.2 million for the month.

Having made it across that line, Pennsylvania will likely remain north of $200 million each month in 2024 or close to it. The 2024 projection shows that it might dip slightly below that during the summer slump in June and July. If business is a bit slower than expected in February, the shorter month might also have the same effect. With 2024 being a leap year, however, the drop in February won’t be quite as large as it usually is.

Online Gambling Revenue Highlights — Dec. 2023

New Jersey

- New Jersey online gambling sites won $180.3 million in December 2023, up 19.1% year-over-year. That’s the highest growth rate the state posted in Q4 and the second-highest of the year, so the Garden State is going into 2024 on a strong note.

- Daily average revenue rose 1.6% to $5.8 million, slightly behind the national trend, which was 2.4%.

- New Jersey’s full-year iGaming GGR came in at $1.92 billion, 1.5% ahead of the projected $1.90 billion.

- Caesars-owned licenses had a strong month, with daily average revenue rising 15.5% for the eponymous license (including the new Caesars Palace) and 19.1% for Tropicana (including the old Caesars Sportsbook & Casino). It’s newly-active Harrah’s license posted a humble $151,058 in its first full month.

Michigan

- Michigan online gambling sites won $181.4 million in December 2023, up 18.7%. Though 1.2% ahead of projection, it was a slower finish to the year than Pennsylvania or New Jersey.

- Michigan continues to battle with New Jersey for second place in terms of market size and remained slightly ahead in December. However, it still trails New Jersey in per capita terms.

- The daily average revenue remained essentially unchanged from November. However, a 0.1% increase was enough to make the difference between rounding down to $5.8 million, and up to $5.9 million.

- Michigan’s full-year iGaming GGR came in at $1.92 billion, making it the only one of the Big Three states to miss its projected total ($1.95 billion), albeit only by 1.2%.

- Penn Entertainment’s online casino has been on a tear since separating itself from the Barstool brand and switching to Hollywood Casino. Its daily average revenue skyrocketed 51% in December. Its annual growth rate is now similar, at 50.9%, and it has more than doubled its market share in the span of four months, from an all-time low of 1.5% in August to 3.6% in December.

Connecticut

- Connecticut online casinos won $44.2 million in December 2023, boosting the annual growth rate to a staggering 56.0%. That’s the second-highest rate in state history, second only to 56.8% in May. It extends the state’s hot streak enough to force a significant upward revision of its 2024 projection.

- The daily average rose to $1.4 million, an 11.3% increase. That made December the second-strongest month of the year, though well behind September’s 24.6% jump.

- Connecticut’s full-year iGaming GGR came in at $406.2 million, beating the forecasted $370.5 million by 9.6%.

- Connecticut saw a four-point market share swing in December, from a 60/40 split in favor of DraftKings down to 56/44. Mohegan Casino probably managed to peel that slice of the market away from its rival through promotions. Both had been spending at a similar rate in November, but DraftKings cut its promotional budget in half in December, while Mohegan doubled.

West Virginia

- West Virginia online casinos won $15.9 million in December 2023, keeping the annual growth rate at 30.6%, slightly higher than in November.

- The daily average rose to $511,331, up 6.2%. It beat the forecast by 5.0%, making for three consecutive positive months to close out the year.

- The Mountain State’s solid Q4 was not enough to overcome a very weak summer. It ended the year with a total of $157.4 million in aggregate iGaming revenue, 2.9% below the projected $162.1 million.

- The Greenbrier is trying to battle its way back into a dominant position as the state’s leading license-holder. With FanDuel, Golden Nugget, and BetMGM under one roof, it once held over 50% of the market, but slipped to a low of 39.4% in October. Over the last two months of the year, it has battled back to 43.9%, putting some room between itself and the second-place contender Charles Town. The latter hosts DraftKings, which may still be the biggest single brand in the market, though we don’t have access to operator-level data to be sure.

Delaware

- Delaware’s lottery monopoly generated $1,166,592 in revenue from its three online casino sites in December 2023, dropping back into the red with a -0.7% annual growth rate.

- The daily average revenue was $37,632, up 1.2% from November. Delaware’s annual total was just $14.1 million, or 16.7% less than the projected $16.9 million. However, we can probably assume that 888 Holdings, the lottery’s technology partner for over a decade, was winding things down as it prepared to hand over the reins.

- BetRivers, the state’s new operator, opened for business shortly after New Year. There’s no knowing what 2024 revenue will look like for Delaware, though it’s unlikely to be any worse. It might continue to chug along at around $1 million per month as it has been, or Rush Street’s overhaul to the offering could bring its revenue more in line with other small states. A version of Delaware earning as much per capita as West Virginia would be pulling in over $7 million per month. That’s likely much too optimistic, but it’s entirely possible that state revenue could double or triple with the new operator.

US Online Gambling Revenue Summary Table

| State | GGR - December 2023 | Monthly Change | Annual Change | Full Year Total | vs. Forecast |

|---|---|---|---|---|---|

| Pennsylvania | $204,224,661 | +3.0% | +22.4% | $2,105,590,967 | +1.9% |

| Michigan | $181,407,932 | +0.1% | +18.7% | $1,923,857,576 | -1.2% |

| New Jersey | $180,308,287 | +1.6% | +19.0% | $1,923,742,049 | +1.5% |

| Connecticut | $44,247,901 | +11.3% | +56.0% | $406,238,603 | +9.6% |

| West Virginia | $15,851,271 | +6.2% | +30.6% | $157,352,872 | +5.0% |

| Delaware | $1,166,592 | +1.2% | -0.7% | $14,073,458 | -16.7% |

| US Total | $627,206,644 | +2.4% | +22.3% | $6,530,855,525 | +1.1% |

Notes on the Data

- Raw data for this article comes from reports issued by the state regulators: the New Jersey Division of Gaming Enforcement, Pennsylvania Gaming Control Board, Michigan Gaming Control Board, West Virginia Lottery, Delaware Lottery, and the Connecticut Department of Consumer Protection.

- 2023 online gambling revenue projections are original calculations performed by News Managing Editor Alex Weldon on behalf of Bonus. Please cite Bonus and Alex Weldon if reporting projected numbers or market performance compared to the projections. Weldon’s 2024 projections are found at PlayUSA instead, and these monthly summaries will migrate to that site as well, starting next month.

- Monthly growth figures are adjusted for the number of days in the month. That is, they represent the change in daily average revenue, not full-month gross revenue.

- West Virginia reports revenue weekly, not monthly. Its monthly totals are an estimate, assuming that revenue for partial weeks is distributed evenly between the seven days.

- Pennsylvania only reports adjusted revenue (gross revenue, less promotional spending). Bonus calculates gross slots revenue by subtracting payouts from coin in, but no such data is available for table games and poker. Therefore, actual gross revenue is probably somewhat higher than what we report.

Previous Monthly Trends

- June 2023—US Online Casinos Win $3.1B in H1, May Approach $6.5B Full-Year Forecast

- July 2023—US Online Casino Industry on an Even Keel Through Summer Doldrums

- August 2023—Pennsylvania Online Casinos Win $172 Million as Fall Upswing Starts Early

- September 2023—US Online Casino Revenue Growth Is Accelerating for the First Time in Years

- October 2023—West Virginia Online Casinos Surge in October, Change in Market Leadership Likely

- November 2023—American Online Casino Gamblers Break Records in November