Americans like to complain that sports betting ads are “everywhere.” However, perception meets reality when it comes to Super Bowl ads. That’s especially true for US online casino and sports betting operators. Because Americans think online gambling advertising completely surrounds them. However, only BetMGM and FanDuel bought commercials for the Big Game.

Even so, ask Americans what they believe, and they will say they are “so sick of those sports betting ads — they’re everywhere!” Even some legislators believe the same, introducing bills to limit marketing that doesn’t exist.

So, on Feb. 11, will Americans notice two of the Big Game’s 70 commercials on CBS come from legal online gambling operators? Or will they complain that five auto manufacturers are airing six ads, according to Adweek‘s Jameson Fleming? Toyota’s second commercial is on Univision.

Chances are, they will notice the two Super Bowl ads for online gambling operators:

- BetMGM‘s Super Bowl debut features actor Vince Vaughn telling Americans that everyone but ex-NFL star Tom Brady can bet on sports with the legal app. NHL legend Wayne Gretzky appears. Vaughn used to be the online casino ambassador for Caesars Sportsbook and Casino.

- FanDuel is also scheduled to appear. However, the No. 1 US online sportsbook had to reformulate its $14 million, 60-second spot featuring ex-NFL player Rob Gronkowski and actor Carl Weathers. On Feb. 1, the star of the Rocky movies passed away. Ad Age’s Jon Springer reported on Feb. 6 that the late Weathers would remain in the ad. It’s unclear how wrestler John Cena, who was also part of the marketing campaign, may be included.

However, $21 million from BetMGM and FanDuel is a small percentage of the more than $600 million in ad revenue Adweek Bill Bradley says will come to Paramount.

Simultaneously, Adweek‘s reporting may better explain why Americans feel like ads surround them. For $7 million per 30-second commercial, Paramount provides “placements on CBS, Paramount+, and Nickelodeon.” Earlier, Jameson mentioned Univision.

Meanwhile, gambling and alcohol ads won’t appear on Nickelodeon because that channel targets minors. So, four beer brand commercials will also be absent.

UPDATE: 02/12/2024

DraftKings did air a 30-second commercial during the Super Bowl, according to iSpot.tv. It featured comedian Kevin Hart and former NFL coach Jimmy Johnson.

BetMGM ran a 30-second commercial and FanDuel offered two 30-second spots, also according to iSpot.tv. Also, FanDuel did include the late Carl Weathers.

That total of 120 seconds of Super Bowl ads and four commercials from three operators may have cost $28 million. That’s primarily because the Big Game reaches a large audience, which iSpot.tv estimated was nearly 127 million people.

DraftKings Has No 2024 Super Bowl Ads

Will Americans notice DraftKings isn’t even there?

Unlike 2023, when it showcased comedian Kevin Hart, DraftKings didn’t buy a Super Bowl ad this year.

So, are Americans just perceiving ad saturation?

When states were beginning to legalize online casino, poker, and sports betting, it’s true that ads were everywhere. Online gambling operators were distributing what’s called “brand awareness” campaigns in 2018. Television alone saw hundreds of millions of dollars spent on commercials in subsequent years. (For those seated in the balcony and muttering “ahem,” yes, Delaware and New Jersey already offered legal online casino gambling.)

As state marketplaces matured and bettors chose their apps, operators began spending less on advertising.

For instance, at this point, Americans know DraftKings is an online gambling site. Industry watchers know it’s a significant player. At Bonus, we call DraftKings one of the Big Three online casino operators. That means BetMGM, DraftKings, and FanDuel dominate US market share in the category.

So, it was a bit of a shock to see that content from DraftKings wasn’t listed among the 2024 Super Bowl ads.

In 2023, what sports betting insiders call “the duopoly” of the best-known and highest revenue-producing sportsbooks — DraftKings and FanDuel — both aired Super Bowl commercials. Adweek‘s Stephen Lepitak and David Cohen reported that both bought 30-second spots, which retailed for $7 million each.

No Sportsbook Ads Ranked in 2023 NFL Season

Americans weren’t surrounded by sports betting ads, according to the 2023-24 NFL Regular Season TV Ad Report.

The iSpot.tv research tallied ad impressions from Sept. 7, 2023, to Jan. 7, 2024. Online gambling operators didn’t make the list.

Automakers, fast food brands, and auto and general insurance companies accounted for 30.06% of TV ad impressions.

One online gambling did show up among “new” advertisers. However, it was outranked in spending by an ad for medicine to combat hot flashes during menopause.

iSpot.tv wrote:

ESPN wasted no time launching the ESPN Bet service with a TV ad blitz; the service didn’t debut until early November, yet still tallied a media value of $23.5 million for ads during NFL games alone this season.

Cementing the proof that women do watch football, despite being primarily known in online gambling circles for playing slots, ESPN Bet‘s commercials feature women talking knowledgeably about wagering.

Is Perception Better Than Reality?

Nine auto and beer advertisers are doing their best to win hearts and minds on Sunday. Paramount will even have 12 Super Bowl ads, according to Variety‘s Tatiana Siegel and Rebecca Rubin. Meanwhile, two online gambling operators will be greeted by groans, even as millions of spectators place bets on their apps.

Will the groans overshadow the revenue? Negatively impact it?

Probably not.

Even before its Feb. 11, 2024, Super Bowl ad debut, BetMGM was banking on being present in consumers’ minds without being on their televisions. That’s because BetMGM was counting on brand recognition, which is still working. The online operator is the result of the marriage between renowned retail casino giant MGM Resorts International and its tech partner, Entain. The joint venture is clearly meant to be synonymous with the MGM brand.

As a result, BetMGM historically didn’t have to pay as much to acquire customers as other operators spent.

As ad measurement firm Disqo put it on Feb. 8, 2024:

Big Game presence moves the needle in brand perceptions for emerging categories far more than it does for a household name.

In colloquial terms, some brands live rent-free in consumers’ minds.

However, BetMGM recently fell from its No. 1 US online casino market share position. DraftKings claims it holds that throne.

Perhaps that’s part of the reason BetMGM’s spot is among the 2024 Super Bowl ads.

This is FanDuel’s second year in the scrum of Super Bowl ads, but it’s long held the No. 1 market share in online sports betting. In marketing terms, the commercial may be a “customer retention” effort.

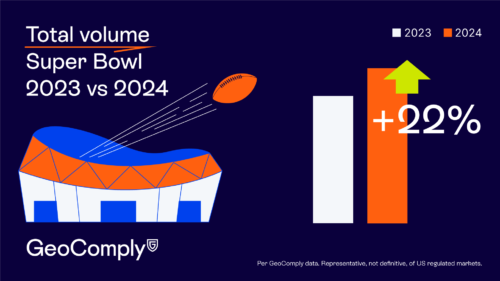

Because in 2023, John Pappas from the geolocation data company GeoComply told Bonus that the Super Bowl wasn’t actually the top day for North American legal gambling app transactions. That honor belonged to the World Cup.

Super Bowl Ads Reflect Reality, Too

As much as Americans complain about the perceived ubiquity of online gambling ads, the commercials are a result of their actions.

The gambling industry trade group American Gaming Association (AGA) announced on Feb. 6:

28.7 million adults, or 11 percent, intend to place online wagers using a legal US sportsbook.

That’s a sliver of the story because the AGA forecasts nearly 68 million adults, or 26% of Americans, will bet on the 2024 Super Bowl. That translates to a 35% increase over 2023, the research shows.

Also, prognosticators believe Super Bowl 2024 will reach more Americans than Nielsen‘s 2023 estimate of 113 million Super Bowl 57 viewers.

That even pays off for the online casino arms of the sports apps.

Because not only are Americans watching and betting, but they’re flipping over to online casino apps to play those games, according to FanDuel.

FanDuel Casino saw increased traffic during the 2022 Super Bowl, the company told Bonus.

That cross-traffic happens on DraftKings, too. On Nov. 3, 2023, DraftKings Co-Founder and CEO Jason Robins told investors that the company cross-sells iGaming to sports bettors, who tend to be on the sportsbooks during events.

Robins said:

iGaming is kind of there and is the same all the time. So while certainly we have overall activity differences, because more customers on the platform for sport mean more cross-sell into iGaming, on the individual customer basis their behavior isn’t going to change a whole lot throughout the year. There’s some seasonality to it. People tend to, during holiday times, have more down time and things like that.

But it’s much less pronounced than the OSB customer, much more steady throughout the year.

So, as iSpot.tv confirmed in August 2023 research, sports betting ads aren’t everywhere. Plus, the number of sportsbook commercials is decreasing during sports events.

However, ads are beginning to move to general programming that adults who are interested in gambling tend to watch.

That means sports betting Super Bowl ads other than the ones from BetMGM and FanDuel are just perceptions, living rent-free in your brain.